“Write it in your heart that every day is the best day of the year.” – Ralph Waldo Emerson

It’s that kind of pure, unbridled enthusiasm and belief that can propel your life and your business to unlimited success. For in the knowledge that every day begins anew, full of fresh promises, hope and the opportunity to work, even if the previous day was not the best, it’s the faith knowing that if you do it day-by-day, then your work will inevitably be a reflection of the grandeur of your dream.

That dream. That journey. Your story.

Everyone has a story.

I am Mark Brodinsky and this is Storytelling for Business.

_________________________________________________________________________

Storytelling for Business: Discipline and Faith

“I don’t think there’s a better opportunity in these United States to change your life.” – Eric Chelekis, Insurance Guy Eric

Start small, believe, work, persevere, grow. Sometimes the smaller your beginnings, the greater your struggles, the easier it is to see and feel the success which comes from never giving up.

Eric Chelekis’s story starts right there, in a small town, Pleasant City, Ohio.

“There were 450 people in the town I grew up in,” says Eric. “There was one main street, a half-mile long and right in the middle of the town was our house. About seven houses up in one direction were my mother’s parents, my grandparents’ house, in the other direction another seven houses down, was my uncle and my cousins. That’s close. There wasn’t a store or a stoplight on our street. It was seven miles to the nearest grocery store.”

Today, Eric lives in the big city, Atlanta, Georgia, in a beautiful home and as a successful Satellite Division Sales Leader for USHEALTH Advisors. USHA is a subsidiary of USHEALTH Group, a UnitedHealthcare company, offering flexible health coverage and supplements to individuals, families and the self-employed. Eric says USHEALTH Advisors has, “completely changed my life.”

Yet the company is just the opportunity, it’s the vehicle, but it’s what you make of it, how you drive your success, where the real change takes place. Eric knows it’s all about discipline and he comes to it naturally.

Because naturally, Eric is an athlete.

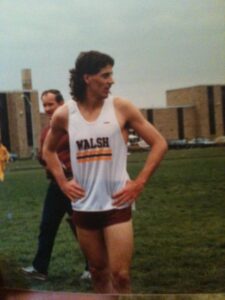

“I was an athlete all through college,” says Eric. “I was a decathlete and in fact, I finished 8th in the country in 1992. Athletics got me through undergrad at Walsh University in Ohio with very little debt. I got my biology pre-med degree at the school, while at the same time competing against all the big schools in the decathlon. For those unfamiliar, the decathlon consists of ten track and field events, everything from pole vault, high jump, long jump, javelin, shot put, discus, 110-meter hurdles, 100-meter dash, 400-meter run, and — wait for it — a 1500-meter run. “There are not a lot of people who do this,” says Eric, “because you have to do a little bit of everything. To finish 8th in the nation was a pretty big deal.”

Coming out of college Eric had all the tools, especially academically and physically, to compete in the real world. What Eric wanted next, was to go from his small town in Ohio, to the big city in Georgia and get his chiropractic degree, another 3-1/2 years of schooling, year-round. But even with his degree in hand from Life University, and as a former accomplished and decorated decathlete, Eric wasn’t prepared for the “hurdle” life would throw at him next.

He had already experienced one of the biggest challenges of his life – losing his mom to cancer, just one month before Eric was to begin his senior year of high school. But now, it wasn’t his heart that hurt, it was what lay before him, a mountain of debt.

“My family didn’t have the money to help me through college,” says Eric. “When I graduated I had $200,000 in student loans. I couldn’t afford to open my own practice so I had to go to work for other people. I ran clinics for some of the biggest practices in Atlanta, but the pay was not that great, it was ten-hour days, weekends too when you were on call. I did it for 18 years, living paycheck to paycheck, never making more than $75,000 in a single year. When you can’t afford to run your own show, you make what you make, no more. My college loan debt ballooned from $200,000 to $350,000 because I couldn’t make the monthly payments. I also had a huge tax burden. I was in a position where any little thing could have put me over the edge. I got divorced when my son was four but somehow I figured out a way to still make his life special, even when I was drowning in debt, feeling like there was no chance of ever getting out of it.”

Then, on November 12th, 2013, after 18 years in the business, Eric got fired.

“That finally pushed me to the edge,” says Eric. “It was one week later that I met with Chris Montague. I had received a call about my online resume and about a day or two later I was sitting in a pitch with Chris. Chris’s dad Andy and Taraina McCants were about to open an office in Atlanta. I almost didn’t go to the pitch because when I Googled the company back then I didn’t find anything. But I figured, what the heck, I’ll go, I’ve got nothing more to lose. Once I heard about the opportunity, I signed the docs to get the training started. I was the third person hired in the office and the only one at the time who stuck it out. I’m so thankful I did because it changed my life.”

But with change comes growing pains. The misperception is that a change in environment or opportunity will simply bring about immediate results, just because you’ve agreed to make a change, the reality is, being in the space isn’t enough, what comes next is the work you put in. The math-life equation works like this: attitude + perseverance = success.

Being the former decathlete, Eric knew that the new beginning was just putting him at the starting line, the gun was about to fire, the next run and the next hurdles were right in front of him.

“I had been living paycheck to paycheck with no money in savings,” says Eric.”I had a month and a half before I wouldn’t be able to pay my bills. But I got my license and I had five-to-six sales opportunities lined up even before I was licensed. Back then it was face-t0-face and we did paper applications, not like today where it’s almost all virtual sales and electronic apps. But with two days to go before Christmas in 2013, I got my first paycheck, $2,700, and I was able to buy some Christmas gifts for my son.”

“And there were still times after that I knew I had to make a sale, or I couldn’t pay the rent next week. I talk about that with my agents a lot. Many are broke when they come here and that’s the hardest part, to get them past that mindset. It’s not easy to work with no money, and yes, you have to make money, but it can be done. There were days, early on, I would wake up in the morning and sit at my desk, talk to Chris and get any leads, if there were any, sit in front of my computer and have tears coming out of my eyes, but I’d wipe the tears and get to work. And through luck or the grace of God, I would make a sale, get it approved and get a paycheck by Monday. If I had $3,000 coming in a month, I could squeeze by and I remember one day having $6000 in my account after paying rent. But I didn’t sit back and live on it, I kept working and then I had $40,000 in the bank by the end of the first year. In the 18 years of being a chiropractor, I never had more than $5000 in my bank account, ever.”

Eric says his first year with USHA he did $384,000 AV (annual volume) as a personal producing agent. In year two he did $524,000, in year three, $624,000 and then once most everything went to virtual sales, he did $1.6 million, then more than $1.8 million. And the beat goes on.

Eric credits his discipline to working the hours, working on himself, and his great relationships with his clients, as big bricks in the foundation of his success.

“The greatest strategy for success here is persistence and hard work, but I also pride myself on really good customer service,” says Eric. “When I wrap up the sale, I make sure my clients save my name and number in their phones and I save their name and number in mine. That way when they call I know who it is and I can call them by their first name when I answer. I also do this with potential clients, prospects, as well, so if they call me back I can answer calling them by name.”

Eric says he works hard, but nearly every day he also takes time for himself, to stay in shape. As a former athletic star, he knows the body affects the mind. “I work the hours I need to work, and then nearly every day at 5 pm I’m at the gym, except for Wednesdays which are my long days,” says Eric. “And I talk to the agents about this all the time, not just about taking care of yourself, but about discipline and competitiveness. If you are not competitive, if you don’t have the drive to do better, than how will you become more successful? I see agents who make a big paycheck and then they’re not in the office for some reason. I’m the guy if I make a $15,000 paycheck, the next week I’m telling myself I have to get back on the board. If you are complacent, or happy where you’re at, that will not help you to grow.”

The growth of his team and his personal brand are big goals for Eric. He says another component to his consistency is now tied to social media, building a name for himself online on his business Facebook page: Insurance Guy Eric.

“About two years ago I started getting my finance’ Mony, (Monica), to do my social media stuff,” says Eric. “And at this point, it’s where I get 90% of my business from, as well as from referrals. Then I can spend most of my days trying to help as much as possible training and getting my new agents up and running. My Division Leader, Shannon Dempsey and I split the responsibilities of hiring and doing the pitches to get people contracted and I can concentrate on that because most of my business is from the social media prospects messaging and calling me. It’s been the biggest blessing ever. I made a lot of calls in the first 4-1/2 years, but now that I have Mony doing social media I teach all the people in my office what she does and how she does it. She’s somewhat obsessed with it, she works more hours than me!”

Besides discipline and branding, there’s one more stone in the path of Eric’s journey to success here at USHA and it came from the hands of a prospective client, and then, in turn, from a higher power.

“During my first year with the company I had been here about two months at the time,” says Eric. “I had an appointment with this guy and his name was Tommy Cho. Tommy owned a karate studio about 45 minutes across town. I drove out there and did a presentation on the products and at the end Tommy said, ‘I like what you have, but honestly my wife and I are trying to build a house right now and we can’t afford it.’ “I said ok, but as he’s walking me out, he had this stack of books on a table. He asked if I had any kids. I said, ‘yes I have a son.’ “And so he gave me a book called, Jesus Always for Kids. It’s a daily devotional book, so I took it home and started reading it myself and reading it every morning. I would shower, get ready, sit on the end of my bed, read the daily devotional and say a short prayer. It was funny, the passages didn’t always specifically speak to me because it was written for kids, but you could still apply the message to your own adult life either way.”

Eric continues, “I had started the book on January 1st of that year and was doing the daily devotional every day, and in December I had about one week to go in the year and the book would be coming to an end. I was just thinking I’m gonna have to get a new book soon when Tommy calls me. He says he’s ready to do the deal for the health coverage. So I drive back out there and while we’re talking I said, ‘I don’t know if you remember the last time I was here you gave me that book for my son. I’ve actually been reading it myself.’ “And so he then goes and gets me another book, Jesus Always, but this one for adults. I always think about that. Here I am almost a year later, about to end the first book and Tommy calls me out of the blue and then gives me another book. I made the sale and I got a brand new book for the new year. And for the last six years, every year, I get another daily devotional book. I get my shower, I get dressed, I sit on the edge of my bed and read that daily devotional and then I say a prayer for family, friends, agents, etc, then I start my day. I do it every day, even if it makes me late, I do it. It centers me and it gets me right for the day.

Nothing like a little discipline and faith to create a great life.

Until next time, thanks for taking the time.

Your Storyteller,

Mark Brodinsky

Make USHEALTH Advisors your next career! Click and apply, (https://www.ushacareers.com/apply/)

_____________________________________________________________

Become part of The Billion. You can learn more about Mark Brodinsky and his #onebillion mission at, (http://markbrodinsky.life/)